Are your Municipal

Bond Funds safe?

of municipal bond funds* have over 10%

exposure to below investment grade

and non-rated bonds

Don’t let your clients

get caught off guard

years, investors have relied on Thornburg municipal bond funds for consistent income

and stability using:

• Investment grade bonds

• Defined duration

• No leverage

Thornburg’s reliable approach to municipal bond investing gives you access to different parts of the

yield curve, for example:

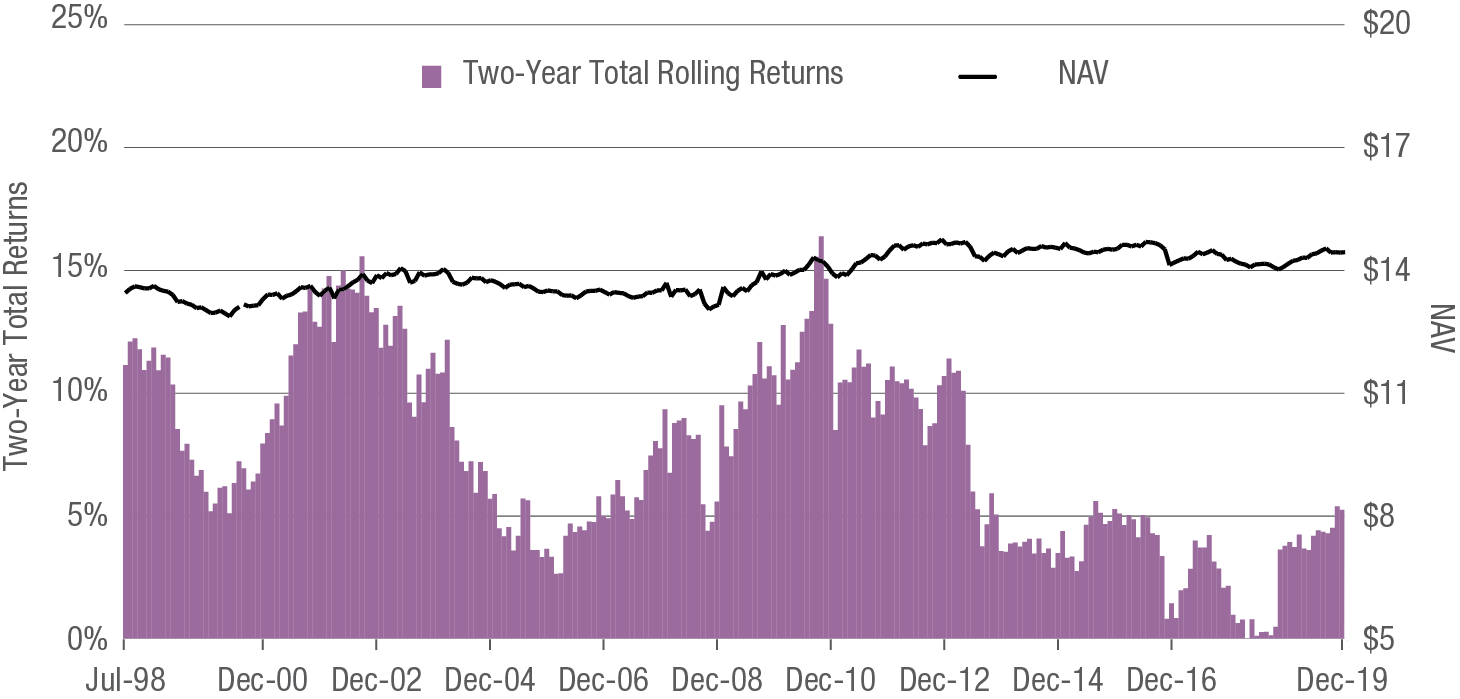

Thornburg Limited Term Municipal Fund - I Share (average duration: 3.5 years)

100% positive returns on a rolling 2-year basis

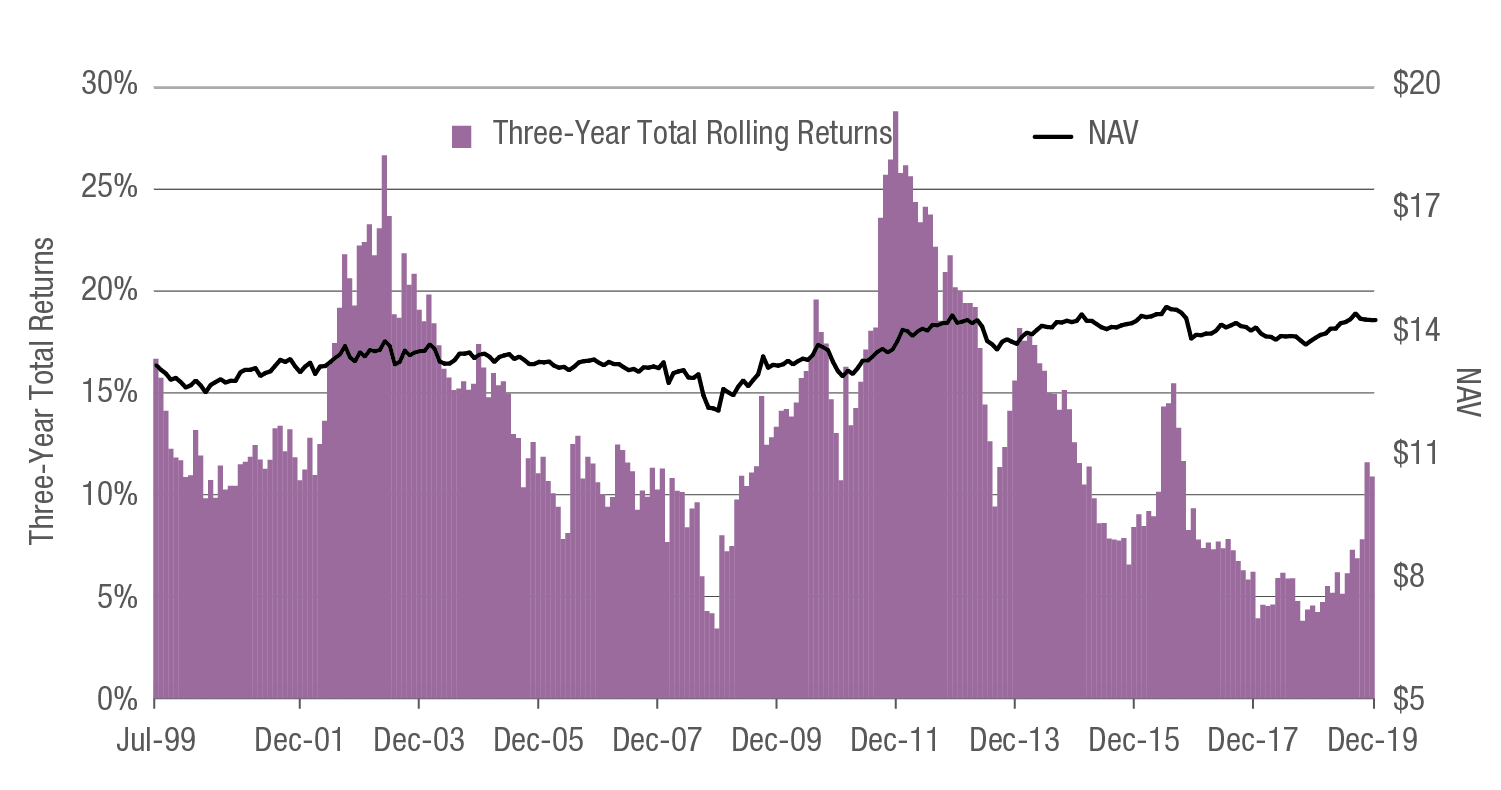

Thornburg Intermediate Municipal Fund (average duration: 4-6 years)

100% positive returns on a rolling 3-year basis

Now available at lower fees

Fast Facts

Thornburg Limited Term Municipal Fund – Profile | Fact Sheet

Thornburg Intermediate Municipal Fund – Profile | Fact Sheet

Thornburg California Limited Term Municipal Fund – Profile | Fact Sheet

Thornburg Strategic Municipal Fund – Fact Sheet

Contact a Thornburg consultant:

Intermediate Municipal Fund

I Share (THMIX) 55 bps

A Share (THIMX) 79 bps

Strategic Municipal Income Fund

I Share (TSSIX) 59 bps

A Share (TSSAX) 81 bps

California Limited Term

Municipal Fund

A Share (LTCIX) 49 bps

A Share (LTCAX) 75 bps

Now at lower fees:

*Source: Morningstar. 92 of 218 funds categorized as Morningstar

National Short, Intermediate and Long municipal funds

Rolling returns are useful for examining the behavior of returns for holding periods similar to those actually experienced by investors. Rolling performance in the chart above represents two-year periods, updated monthly. Performance is not annualized.

Rolling returns are useful for examining the behavior of returns for holding periods similar to those actually experienced by investors. Rolling performance in the chart above represents three-year periods, updated monthly. Performance is not annualized.

Average Annual Total Returns

I shares - LTMIX 1-Yr: 4.06% 3-Yr: 2.60% 5-Yr: 1.84% SINCE Incep.: 3.71%

as of 12/31/19

Periods less than one year are not annualized.

Class I shares may not be available to all investors. Minimum investments for the I share class may be higher than those for other classes.

Periods less than one year are not annualized.

Class I shares may not be available to all investors. Minimum investments for the I share class may be higher than those for other classes.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 877-215-1330. There is no up-front sales charge for class I shares.The total annual fund operating expenses are as follows: I shares, 0.63%. For more detailed information on fund expenses and waivers/reimbursements please see the fund’s prospectus.

as of 12/31/19

I shares - THMIX

1-Yr: 5.90%

3-Yr: 3.50%

5-Yr: 2.54%

SINCE Incep.: 4.32%

Average Annual

Total Returns

Contact a Thornburg consultant:

Intermediate Municipal Fund

I Share (THMIX) 55 bps

A Share (THIMX) 79 bps

Strategic Municipal Income Fund

I Share (TSSIX) 59 bps

A Share (TSSAX) 81 bps

California Limited Term

Municipal Fund

A Share (LTCIX) 49 bps

A Share (LTCAX) 75 bps

Now at lower fees:

Contact a Thornburg consultant:

Intermediate Municipal Fund

I Share (THMIX) 55 bps

A Share (THIMX) 79 bps

Strategic Municipal Income Fund

I Share (TSSIX) 59 bps

A Share (TSSAX) 81 bps

California Limited Term

Municipal Fund

A Share (LTCIX) 49 bps

A Share (LTCAX) 75 bps

Now at lower fees:

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 877-215-1330. There is no up-front sales charge for class I shares.The total annual fund operating expenses are as follows: I shares, 0.45%. For more detailed information on fund expenses and waivers/reimbursements please see the fund’s prospectus.

Periods less than one year are not annualized.

Class I shares may not be available to all investors. Minimum investments for the I share class may be higher than those for other classes.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 877-215-1330. There is no up-front sales charge for class I shares.The total annual fund operating expenses are as follows: I shares, 0.65%. Thornburg Investment Management and/or Thornburg Securities Corporation have contractually agreed to waive fees and reimburse expenses through at least February 1, 2021, so that actual Class I expenses do not exceed 0.53%, not including the effects of Acquired Fund Fees and Expenses.For more detailed information on fund expenses and waivers/reimbursements please see the fund’s prospectus.

as of 12/31/19

I shares - THMIX 1-Yr: 5.90% 3-Yr: 3.50% 5-Yr: 2.54% SINCE Incep.: 4.32%

Average Annual Total Returns

Past performance does not

guarantee future results.